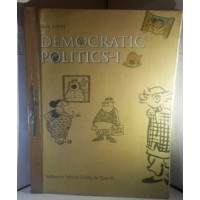

Corporate Tax Planning and Business Tax Procedures with Case Studies by Dr. Vinod K Singhania

- The law stated in this Book is as amended by the Finance Act, 2017.

- Book One showcases the law of income-tax in a structured and concise manner so as to provide the theoretical background for understanding the complex Tax Planning and Business Tax Procedures in real world scenarios.

- Book Two covers Corporate Tax Planning (corporate tax, setting up a new business, financial management decision, remuneration planning, non-resident and business restructuring).

- Book Three covers Tax Procedure and Management (return, assessment, appeals, penalties, Settlement Commission, search and seizure, advance tax, TDS, e-TDS and interest).

- Numerous multiple choice problems are included at the end of each chapter so as to enable clarity of thought and quick revision.

- Each para (with a distinct number) starts with analytical discussion supported by well-thought out original problems.

- The book is amended up to August 1, 2017.

- A useful and handy book, especially where the reader is

- a student of tax planning and management,

- in the tax consultancy profession,

- an official in tax department,

- a taxpayer who wants to learn different techniques to legally minimize his current and future tax bills.

| Books Information | |

| Edition | 20th |

| Condition of Book | Used |

Rs.230.00

Ex Tax: Rs.230.00

- Stock: In Stock

- Model: sg706